Ideal Assets for Tokenization P3: Investor Behavior and Demand

Investor demand—not just technology or regulatory frameworks—is guiding asset tokenization’s trajectory.

In Part 1, we saw how regulatory openness lays the foundation for asset tokenization. Part 2 (part 2.1 & part 2.2) showed that real traction occurs where traditional markets are fragmented or illiquid. Now, let’s shift focus to investor behavior—what institutions and retail investors actually demand—and how that shapes the next wave of tokenization.

Institutions: Chasing Safety, Yield, and Efficiency

TL;DR

Institutional demand for tokenized assets has sharply risen, fueled by three factors:

• Safety: Preference for government-backed or highly rated assets

• Yield: Especially in a high-interest macro environment

• Liquidity/Efficiency: 24/7 trading, real-time settlement, operational flexibility

Institutional investors have been among the first movers in the tokenization space, primarily gravitating toward safe, yield-bearing assets and high-quality alternative investments. Over the past year, a clear favorite has emerged: tokenized U.S. Treasuries and money market funds (MMFs). These on-chain instruments mirror ultra-safe government debt but with the 24/7 settlement and programmability of blockchain. The appeal is straightforward – institutions can park cash in a tokenized Treasury or MMF and earn ~5% yield, while retaining flexibility to move funds on-chain instantly. It’s a crypto-era twist on cash management, and it’s booming.

Traditional finance giants are actively involved. BlackRock’s much-discussed blockchain-based USD Money Market Fund, known by its ticker BUIDL, has quickly become a dominant player after launching in early 2024. BUIDL alone amassed about $2.47 billion in tokenized assets (42% of the on-chain Treasury market) within a year . Franklin Templeton’s on-chain U.S. Government Money Fund is not far behind, with a $706 million market cap. Even Fidelity is getting in on the action, recently filing to launch an “OnChain” version of its Treasury MMF. These funds show how blue-chip asset managers are responding to client demand for blockchain-based versions of familiar products.

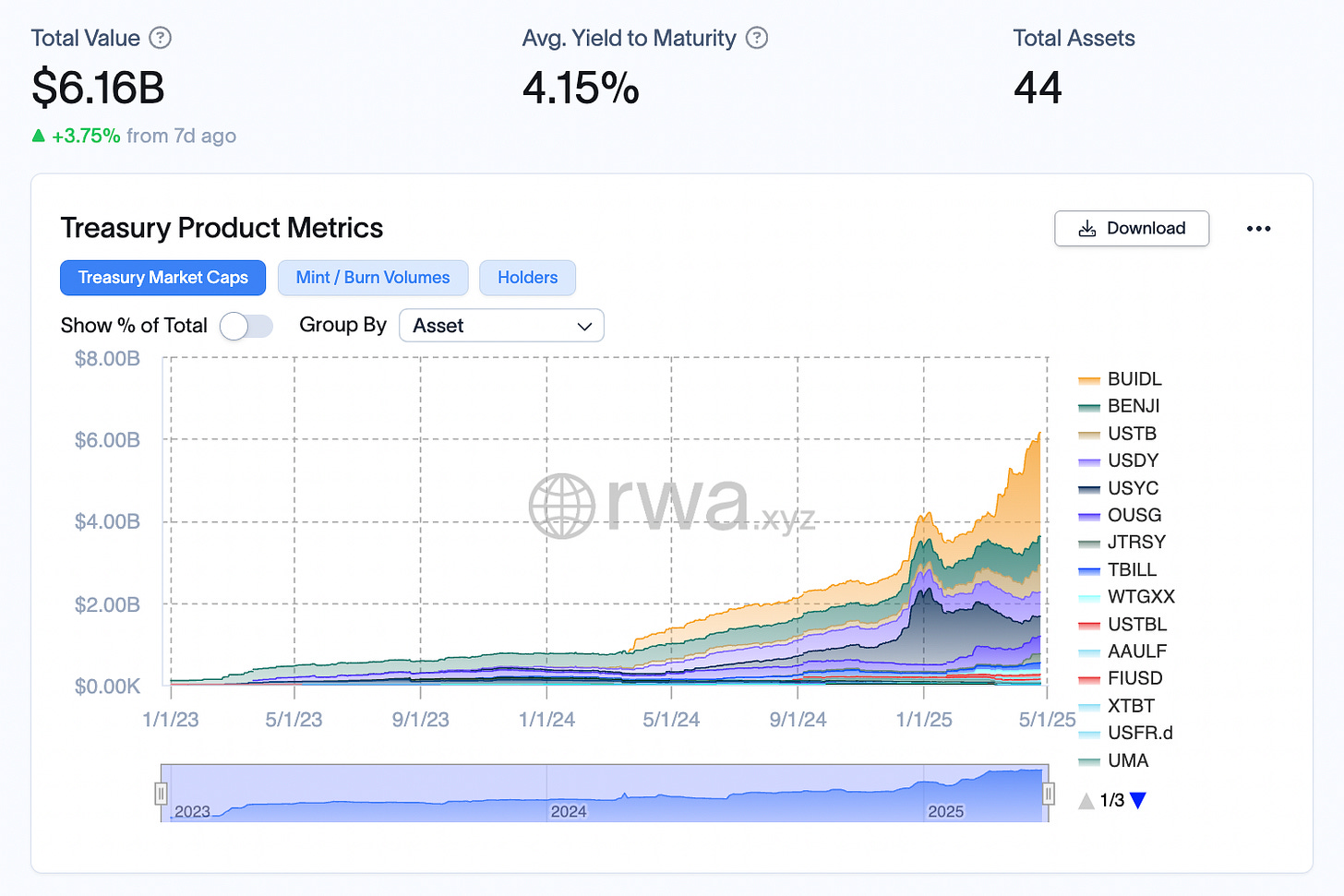

Crucially, the total value of tokenized U.S. Treasuries on public blockchains has surged in step with this institutional interest. It recently hit an all-time high of nearly $6 billion, up from just $4 billion at the start of the year. Ethereum remains the chain of choice for these assets (hosting roughly $4.3B of that value), though other networks like Stellar and Solana also host notable tokenized Treasury funds. This growth reflects rising confidence that blockchain can modernize fixed-income markets without compromising on safety or liquidity. Institutions see tokenization as a way to make traditionally stodgy assets more efficient.

At the same time, institutions are looking beyond just government debt. There’s growing interest in tokenized private equity, credit, and other alternative assets that have historically been hard to access. Tokenization platforms like Securitize are partnering with major asset managers to put private funds on-chain. For example, Securitize enabled Hamilton Lane to offer a tokenized feeder into one of its flagship private equity funds, dropping minimum investments from $5 million to just $20,000. That fractionalization opens the door for smaller institutions and accredited investors to participate in top-tier PE funds. Securitize has also tokenized funds for KKR and BlackRock – including helping BlackRock launch BUIDL in tokenized form. This “alts on-chain” trend is about giving investors easier access to high-return opportunities. A growing appetite for alternatives among wealth managers and institutional clients is driving it: one study estimated that if high-net-worth portfolios upped their alternatives allocation to 20% (typical for institutions), it could mean $12 trillion in new funds flowing into alts. No surprise then that even traditional private market firms are experimenting with blockchain. As Carlos Domingo, CEO of Securitize, put it, by digitizing the investment process they aim to “remove barriers” for investors to join high-quality private market deals.

Another demand-side driver for institutions is better collateral and liquidity management. Tokenized Treasuries and funds aren’t just investments; they are also being used operationally. Prime brokerage firms like FalconX now accept tokens like BlackRock’s BUIDL and Superstate’s USTB (another on-chain Treasury fund) as loan collateral. This means trading firms can post a tokenized MMF as collateral for margin, combining the safety of a Treasury fund with the convenience of a crypto token. It’s a compelling use case for any institution active in crypto markets – essentially “safe yield in my wallet, and ready to deploy when needed.” The ability to instantly redeploy collateral is something traditional Treasuries can’t offer (they stop at 5pm and don’t work weekends), so institutions are noticing the efficiency gain.

Finally, we’re seeing forward-looking institutions (and even governments) exploring tokenization of other traditionally safe assets. Projects are underway to tokenize bank deposits, bonds, and other securities in regulatory sandboxes from Singapore to the EU. The common thread is that investor demand is highest for assets that combine low risk with better liquidity via blockchain. It’s likely that the next wave of tokenized assets for institutions will include more short-term debt instruments, investment fund shares, and credit products – essentially extending the “safe yield” category. As regulatory comfort grows, we may eventually see everything from corporate bonds to structured products appear on-chain, but the current demand signals indicate that yield + simplicity is king.

Institutions are starting with the low-hanging fruit: products that feel like what they already trust, just delivered on a new tech rail.

Top Products for Institutions:

BlackRock’s BUIDL: A tokenized USD Money Market Fund, offering stable yield and liquidity. Institutions use it for cash management and DeFi collateral purposes.

Franklin Templeton’s OnChain U.S. Government MMF: Another tokenized money market fund providing traditional security with blockchain efficiency.

Ondo’s OUSG: A tokenized wrapper of a short-term U.S. government bond ETF, designed for accredited investors seeking compliant on-chain exposure.

Ondo’s USDY: A yield-bearing token backed by Treasuries and demand deposits, aimed at non-U.S. institutions and DeFi treasuries.

Securitize: Platform enabling tokenized access to private equity and private credit investments from firms like KKR and Hamilton Lane, democratizing traditionally exclusive institutional assets.

Tokeny: Infrastructure provider specializing in regulatory-compliant tokenization of corporate bonds, structured products, and funds for institutional users.

Maple Finance: a credit-focused protocol enabling institutional lenders to access tokenized private credit markets through KYC-gated, yield-generating lending pools.

Retail Investors: Yield, Stability, and Easy Access

TL;DR

Retail priorities differ, but are equally forceful:

• Stable Value: Tradable tokens that don’t fluctuate like crypto.

• Yield: Why hold stablecoins that pay 0%?

• Ease of Use: Tokenized assets that work like USDC or USDT, but better.

On the retail side (including everyday crypto users and smaller investors), the wish list driving tokenization is a bit different but complementary. Broadly, retail investors want what they’re already comfortable with – like cash and high-yield savings – but with crypto-like accessibility. This explains the enduring popularity of stablecoins, which have become the lifeblood of crypto trading with a combined market value around $235 billion. Stablecoins provide dollar stability in volatile markets, but one thing they traditionally don’t provide is interest. That wasn’t a huge issue when global yields were near zero, but in today’s 5% interest rate environment, users are increasingly asking: “Why hold a token that pays me nothing if I could be earning 4-5%?”

Enter tokenized yield products targeting retail users. One major demand-side trend is the rise of stablecoin alternatives that pay interest – essentially, tokens that maintain a stable $1 value but pass through real-world yield. Tokenized U.S. Treasuries have grown almost 20× faster than stablecoins in the past year as crypto market participants flock to yield-bearing dollars. These instruments appeal to everyone from DeFi traders to casual stablecoin holders. As one trader simply put it, “Why use something that doesn’t give you yield when you can earn extra on top of it?”. The data backs it up: in just the first few months of 2025, as crypto markets slumped, traditional stablecoin growth flatlined while tokenized Treasury assets jumped over 8%. The message is clear – there's a strong retail appetite for safer yield.

Stablecoin issuers themselves have noticed this shift in behavior. Circle, the company behind USDC, even acquired a tokenized Treasury provider (Hashnote) to help serve users looking to earn interest. “We should expect those who post stablecoin collateral as the primary users of tokenized treasuries in order to earn yield on the collateral they are posting,” a Circle spokesperson said. In other words, many crypto users holding USDC or USDT in protocols would happily hold an on-chain T-bill fund token instead, if it yields a few percent.

This demand is spurring innovation like Ondo Finance’s launched OMMF token, which gives global stablecoin holders a 1:1 dollar-backed token that functions like a money market fund and pays yield via daily distributions. According to their blog in 2023, OMMF is designed to be as easy to use as a stablecoin, but with the interest that a U.S. government MMF earns – exactly what many retail (and crypto-native institutional) users have been asking for. As Ondo’s CEO put it, “What stablecoins have done for cash, OMMF will do for money market funds,” bridging the gap between on-chain dollars and traditional yield. However, I couldn’t find any OMMF information on their website and docs.

Beyond yield on cash, retail investors are also drawn to tokenization for access to investments that were previously out-of-reach. Real-world assets like real estate, private credit, and venture capital funds have historically been illiquid or gated to large investors. Tokenization is changing that. For example, platforms like RealT have let everyday crypto users buy fractional pieces of rental properties with as little as $50. On the credit side, protocols such as Goldfinch and Centrifuge have enabled retail (with certain restrictions) to fund loans to real businesses and earn high yields in return. While these ventures are still nascent, they tap into a clear retail demand: the ability to diversify into asset classes beyond stocks/crypto, without the usual friction. In Part 2 we noted that private credit and real estate tokenization is gaining traction because it offers exactly this – lower investment thresholds and new liquidity options for assets that people always wanted exposure to.

Another factor for retail is friction reduction. Tokenization can simplify the investment process – no brokerage account needed, 24/7 markets, and often quicker settlement or liquidity via secondary trading on exchanges. For a tech-savvy global investor, the idea of buying a tokenized fund share in a few clicks (versus piles of paperwork to buy into a traditional fund) is very attractive. We’re seeing this play out in the rise of app-based platforms that package real-world yields into tokens. Two examples are OpenEden and Usual, which have created accessible on-chain vehicles for investing in things like Treasury bills. These platforms handle the complex custody and regulatory compliance in the background, while users simply deposit crypto (like USDC) and receive a token that represents a slice of a Treasury portfolio, accruing interest. It’s all about a smoother user experience for retail participants. As the crypto community often says, “Don’t make me go back to TradFi if I don’t have to.” If a wallet and a dApp can give someone exposure to a bond fund or a high-yield credit product, many will choose that route for convenience.

Of course, it’s not just convenience – trust and transparency play a role in retail demand too. After events like stablecoins briefly depegging and yield platforms collapsing in past years, some investors feel more comfortable when assets are transparently custodied or regulated (as many tokenized securities are). A tokenized MMF from a known institution, for instance, carries the credibility of that fund’s assets plus on-chain verifiability of token supply. This blend of TradFi trust and DeFi transparency is appealing to savvy retail investors. It’s shaping the tokenization market to focus on high-quality underlying assets – nobody wants a repeat of opaque, risky yield schemes. So we see strong retail demand for fully backed, audited tokenized assets like government bonds, and less appetite for esoteric synthetic tokens (though innovative projects like Ethena).

Top Products for Retailers:

OpenEden’s T-Bill Vault: Tokenized short-term Treasuries for retail.

Ondo’s USDY: Acts like a stablecoin but pays Treasury-level yield.

Usual: Fixed-income retail access via plug-and-play DeFi interface.

Ethena’s USDe: A synthetic, delta-neutral stablecoin offering native yield. Already a top 3 stablecoin by market cap.

By the Numbers: Trends in On-Chain Investor Adoption

On-chain tokenized U.S. Treasury assets have surged to nearly $6 billion in value as of early 2025, reflecting rapid growth in demand for blockchain-based yield-bearing instruments. These products – spanning tokenized money market funds and short-term T-bill tokens – have grown dramatically from around $1 billion a year ago, far outpacing the growth of traditional stablecoins over the same period.

The chart above illustrates how multiple issuers (each colored band) contributed to the steep rise, especially through late 2024 and early 2025. Notably, the introduction of major tokens like BlackRock’s BUIDL (yellow band) sparked a large influx of funds on-chain. This momentum underscores a key point: investors are voting with their wallets in favor of tokenized assets that meet their needs.

A few data points stand out in recent on-chain behavior:

Fund flows favor fixed-income tokens. Tokenized Treasury and bond funds saw consistent inflows each month in 2024–25, while purely crypto-yield products stagnated. Investors poured capital into on-chain Treasuries as interest rates climbed – a sign that macro conditions (like 5% yields in traditional markets) directly influenced on-chain demand. We’ve essentially watched an on-chain “fund flow” phenomenon similar to how money moves into bond funds during times of attractive yields, but happening on a blockchain ledger visible to anyone.

Stablecoin holders are converting into yield-bearing tokens. We’ve observed on-chain transaction patterns where large holders of USDC or other stablecoins redeem them in exchange for tokens like OUSG (Ondo’s tokenized Treasury fund) or TBILL (OpenEden’s T-bill token). On-chain analytics firms noted spikes in minting of these RWA tokens whenever there’s a period of low volatility in crypto prices – suggesting traders parking funds into yield. The number of unique wallets holding major tokenized Treasury assets has been climbing steadily, indicating broader adoption. While still small relative to the millions of stablecoin users, this holder base is growing and provides a foundation for network effects (more liquidity, more trading, etc.).

Alternative assets on-chain remain niche but growing. Outside of government debt, other real-world asset tokens have seen modest but noteworthy growth. Tokenized real estate, for example, now counts thousands of token holders globally (across platforms like RealT, Lofty, etc.), and secondary markets for these tokens have facilitated hundreds of peer-to-peer trades – small numbers, but unprecedented for an illiquid asset class. Similarly, pools that finance real-world loans (private credit) have attracted tens of millions in stablecoin capital from yield-seeking crypto lenders. These data points, while not as headline-grabbing as the billions in Treasuries, show a genuine if nascent demand from investors to branch out into diverse tokenized assets for diversification and higher returns.

What asset classes are likely to get tokenized next due to these trends?

The investor wish list provides a guide. Given the success of on-chain Treasuries, we can expect more fixed-income and cash management products (think tokenized corporate bonds, municipal bonds, or even bank CDs) to appear so long as they offer that sweet spot of safety and yield. The strong interest in private equity and private credit from wealth managers suggests more tokenized funds and credit deals are on the horizon – for instance, tokenized venture capital funds or income-producing private debt portfolios that smaller investors can tap into. Real estate tokenization will likely continue expanding as legal frameworks solidify, because the demand to invest in property without huge capital outlay is always high. In short, assets that offer yield, diversification, or inflation hedging – and which can be legally structured on-chain – are primed to be tokenized.

The ideal assets for tokenization, from a demand perspective, are those that investors already want but can’t easily access or utilize through traditional means.

There’s an intriguing mismatch: derivatives and corporate bonds, though highly open, aren't seeing tokenization at scale. Instead, less open markets like real estate and private equity thrive on-chain.

The reason? Tokenization solves practical problems—illiquidity, complexity, and high entry barriers—not just regulatory openness. Institutions and retail investors demand assets that tokenization clearly improves, explaining why assets that seem less open but more problematic in traditional finance become ideal for blockchain solutions.

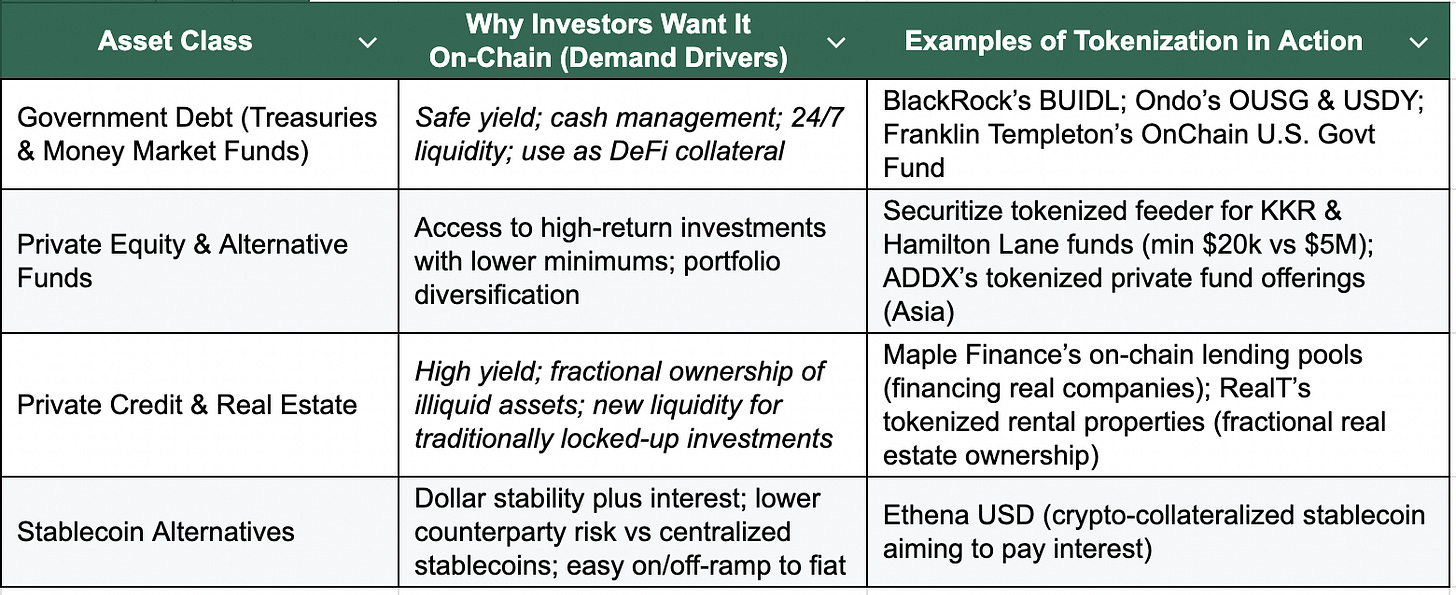

To summarize some of the key demand-side drivers and examples, the table below highlights major asset classes being tokenized, why investors are chasing them, and real examples of platforms addressing that demand:

Table: Investors are primarily seeking either safer yield on idle cash or easier access to asset classes that were previously hard to reach.

Looking Ahead

From big institutions to individual crypto holders, investors are clearly signaling what they want to see tokenized: assets that combine stability, yield, and accessibility. This demand is already reshaping the market – we’ve gone from a few experimental tokenized bonds to billions in on-chain Treasuries, and from abstract discussions of “liquidity” to real examples of people using these tokens as collateral or income tools.

The investor behavior behind this shift is straightforward: if tokenization makes an investment more convenient or more accessible, investors will gravitate towards it.

As a result, the assets getting tokenized next will likely be those with the strongest pull from users. We’re likely to see continued growth in tokenized fixed-income products and funds, and progressively more moves to tokenize high-demand alternative assets like property and private credit.

The ideal assets for tokenization are ultimately defined by the market’s appetite. And right now, the market is hungry for better yields, broader access, and the efficiencies that come from moving value onto blockchain rails. In the next part of this series, we’ll continue to explore this evolving landscape – but one thing is certain: tokenization is no longer just a technology experiment, it’s a response to what investors are actively asking for. The finance world is listening, and token by token, it’s starting to deliver.