Ideal Assets for Tokenization P.1: Regulatory Environment

Tokenization doesn’t happen in a vacuum – it requires a supportive regulatory and legal framework to truly flourish.

My hypothesis: “Assets open to foreign and cross-border investment are ideal for tokenization.”

Tokenization promises to revolutionize how we access and trade assets — turning real-world value like bonds, stocks, and even real estate into digital tokens that can move globally, instantly, and fractionally. But here's the thing: not all assets are created equal. Some are racing toward tokenization. Others remain stuck in legal red tape.

Where laws are clear and asset classes are already open, tokenization doesn’t just work,

it scales.

Tokenization doesn’t happen in a vacuum – it requires a supportive regulatory and legal framework to truly flourish. As we’ve seen, even an open asset class can be derailed by regulators if tokenization isn’t done by the book. Conversely, forward-thinking regulation can turn a maybe into a reality. Globally, we’re witnessing a patchwork of approaches, but some common themes are emerging.

🔗 Openness + Clarity = Traction

Look at where tokenization is thriving:

Government bonds (U.S. Treasuries, EU sovereign debt)

Money market funds

Stablecoins (USDC, USDT)

Selected equities and credit funds (e.g., Securitize, Franklin Templeton)

These aren’t random. They’re assets already globally traded, often by large institutions. And in markets like the EU (MiCA), Singapore (Project Guardian), and Switzerland (DLT Act) — regulators have created explicit pathways for tokenization.

Enablers

On the enabling side, a number of jurisdictions have updated laws to explicitly recognize digital tokens representing assets. Switzerland was an early mover: it adapted its securities law so that a ledger entry (on a blockchain) can legally represent a security, giving tokenized stocks or bonds the same standing as traditional ones. This led to the launch of the fully regulated SIX Digital Exchange, which has since issued bonds natively on DLT and facilitated other tokenized securities trading. Luxembourg adjusted its fund laws to accommodate tokenized shares of funds. Singapore has been very active through sandbox programs like Project Guardian and issuing guidelines for tokenized securities offerings under its existing securities law. The European Union’s DLT Pilot Regime (effective 2023) provides a sandbox for market infrastructures to handle tokenized trading and settlement for a range of assets, essentially giving temporary regulatory relief to try out tokenized markets within certain limits. Abu Dhabi and Dubai (UAE) have set up crypto asset frameworks that also cover security tokens, aiming to attract issuers to tokenize everything from real estate to bonds under a clear rulebook. And within the United States, while federal law hasn’t changed, states like Delaware made it legally possible for companies to maintain stock registers on blockchain, and Wyoming created a new charter for crypto banks and legally recognized tokenized assets under certain categories. These efforts all serve to reduce the legal uncertainty around tokenization, making it easier for the industry to focus on technical and business innovation rather than worrying “will this token be recognized as valid ownership?”.

One major regulatory focus is ensuring that tokenized markets integrate with existing rules on investor protection, market integrity, and financial stability. Regulators emphasize that just because something is on a blockchain doesn’t mean the old rules don’t apply. As the OECD noted, authorities are working to make sure tokenized markets align with goals of financial stability, investor protection, and market integrity, often by extending existing regulations to new token actors and addressing any gaps. There’s also a need for international coordination – because tokenized assets by nature can be traded cross-border, if one country has lax rules it might create risks elsewhere. The OECD warns that cross-border token transactions require cooperation to avoid regulatory arbitrage and to ensure smooth development of tokenized markets. In practice, this means regulators talk to each other (through forums like IOSCO, the FSB, etc.) to share information on tokenization projects and to try to harmonize approaches where possible. We’ve already seen collaborative efforts: for instance, regulators from multiple countries observed and participated in some of the bond tokenization pilots (the EIB’s digital bond had Luxembourg law involved and was settled through France’s blockchain platform for central securities depository).

Roadblocks

Despite progress, there are still notable roadblocks. A big one is the lack of clarity in some jurisdictions on the legal status of tokens. Is a token legally a security, a commodity, a new sui generis asset? Definitions vary. The State Street report posed fundamental questions: does the token legally represent the claim it purports to (say, a share in a company)? Are the rights of a token holder the same as a traditional security holder?

These need clear answers. The United States has been cautious; the SEC treats most tokenized offerings as securities that must follow full registration or exemption processes, which is why many U.S. tokenization efforts have been limited to private offerings for accredited investors (to stay within Reg D or Reg S exemptions). Lack of an overarching regulatory framework (like a “Tokenization Act”) in the U.S. makes issuers stick to case-by-case legal analysis, which is costly and slow. Meanwhile, in jurisdictions that have provided clarity, we see more activity.

Another challenge is regulatory perception. Many regulators are still in learning mode about blockchain. They worry about operational risks (what if the blockchain fails or is hacked?), interoperability (how to integrate token platforms with legacy systems), and governance (who is accountable if something goes wrong in a decentralized system?). The FSB recently highlighted concerns that as tokenization evolves, it could replicate some vulnerabilities of traditional finance in new ways, and called for ongoing monitoring. Crucially, they acknowledged that right now tokenization is small (so not a stability risk yet) but if it scales, things like liquidity mismatches or leverage in DeFi could have wider implications. This implies regulators will likely impose limits or requirements (like disclosures, capital buffers, etc.) on tokenized platforms as they grow, especially if those platforms start to resemble systemically important market infrastructures.

In essence, the regulatory environment is a mix of green lights, yellow lights, and a few red lights. Green, where laws have been modernized (Switzerland, etc.) – here we see tokenization flourishing in the open-asset classes, relatively unhindered. Yellow, where tokenization is allowed but under careful supervision and within existing rules (most places) – here it proceeds but maybe slower and more restricted (like the U.S. accredited-investor-only approach). Red, where either the country doesn’t allow much crypto/token activity at all (some outright bans or hostile stances) or where the asset itself can’t be foreign-held (so tokenization can’t open it up without new law) – in these places, tokenization largely avoids those assets or moves to friendlier shores. The trend overall is towards more clarity. Each successful case study (a regulated tokenized bond issuance, a court upholding a token as legal title, etc.) builds confidence and precedent. Each jurisdiction that rolls out tokenization-friendly regulations puts pressure on others to not fall behind in financial innovation. So while regulatory friction is real, it’s gradually being smoothed out, especially for those asset classes that regulators deem safe enough to experiment with (again, typically the ones already globally open and well-understood, like bonds and funds).

Spotlight: The Regulatory Battle Around Stablecoins

A major regulatory frontier right now is stablecoins—especially who gets to issue them.

Recently, the Wall Street Journal reported that JPMorgan, Citi, Bank of America, and Wells Fargo are exploring a consortium-issued stablecoin. This comes amid growing concern that non-bank issuers like Circle and Tether are gaining too much monetary influence without central oversight.

➡️ Case Study: South Korea The Korea Times revealed that Korean banks are working on a Korean Won stablecoin. In response, the Bank of Korea is urging banks to adopt a central bank digital currency (CBDC) to preempt potential loss of monetary control. Yet Korea, like many nations, lacks a clear regulatory regime for stablecoins.

➡️ In the U.S., the upcoming GENIUS Act aims to clarify this battleground. If passed, stablecoin issuers with >$10B in supply would fall under federal oversight: the Fed for banks, the OCC for non-bank entities. For now, most banks have stayed on the sidelines—but this law could open the door.

If banks can issue stablecoins under a clear legal structure, we may see them band together to defend against unregulated competition. After all, the U.S. is by far the largest market for USD stablecoins.

Why it matters for tokenization: Stablecoins are often the gateway to RWAs. Their regulatory future will define how tokenized assets interact with payments, lending, and DeFi. Whether the future is CBDCs, bank-backed coins, or private stablecoins—tokenized cash is here to stay.

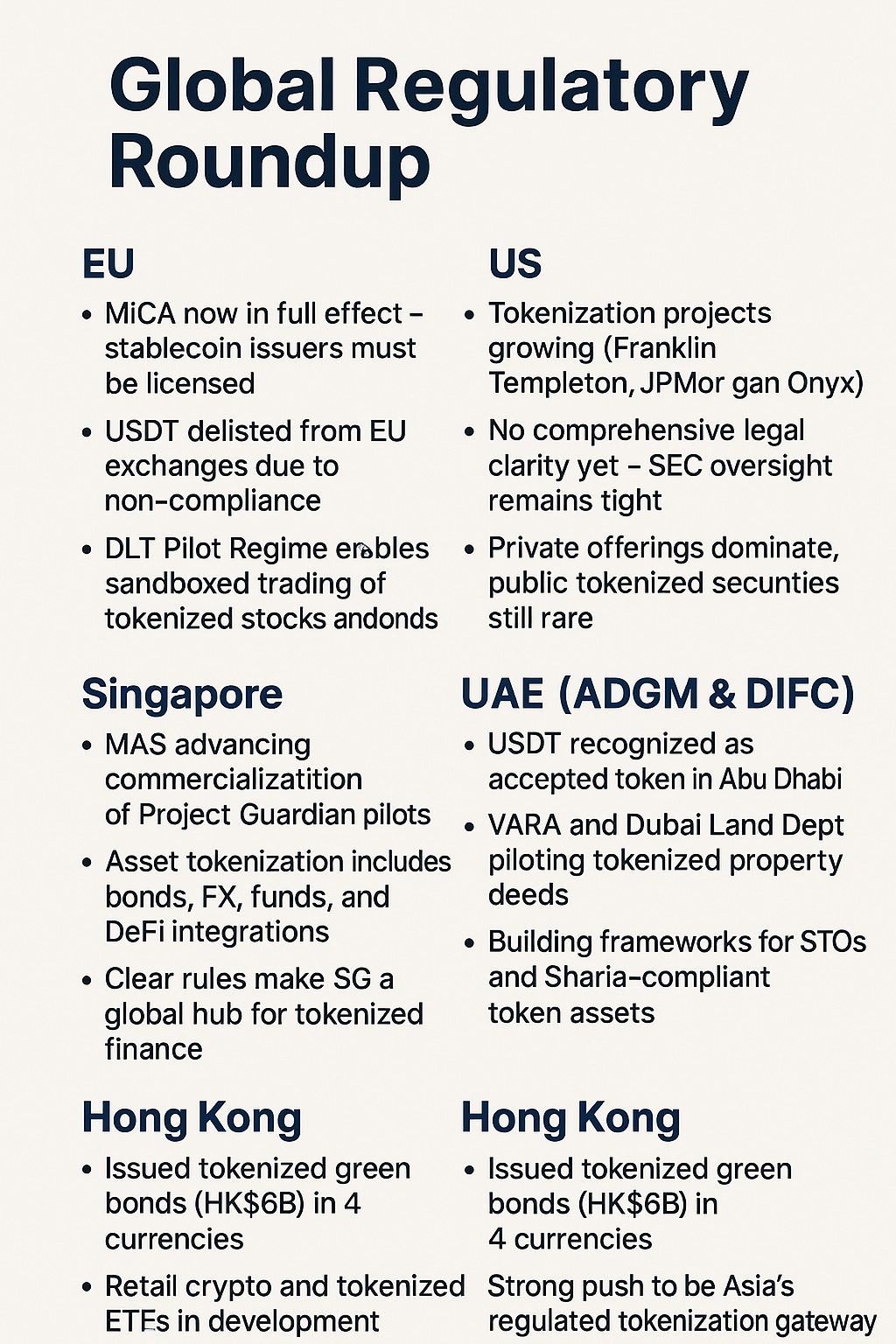

Global Regulatory Roundup

Finally, let’s survey how different jurisdictions are approaching the tokenization trend. The legal and regulatory environment is crucial – it can either supercharge innovation (as seen in Switzerland and Singapore) or slow it down (as in the U.S., to some extent).

European Union (EU): The EU has taken a comprehensive regulatory approach. MiCA, passed in 2023 and phased in by 2024-2025, is a landmark regulation that covers crypto-assets, stablecoins, and token offerings across all member states. Under MiCA, stablecoin issuers (termed “e-money tokens” for fiat-backed, and “asset-referenced tokens” for others) must be authorized and meet transparency and reserve standards (Tether’s Market Cap Plummets as MiCA Regulation Hits | Nasdaq). This is why exchanges in Europe had to delist non-compliant stablecoins like USDT at the end of 2024 (Tether’s Market Cap Plummets as MiCA Regulation Hits | Nasdaq) – only EU-approved tokens can be offered moving forward. For security tokens, the EU launched the DLT Pilot Regime, which from March 2023 allows regulated entities to operate DLT-based trading and settlement for tokenized securities under a sandbox. Several pilots are underway, though full-scale markets under this regime are expected over the next 1-2 years as participants like Euroclear, Euronext, and Deutsche Börse get approval to launch DLT exchange platforms. The EU is essentially saying: “we’ll allow stock and bond tokenization in a controlled environment, and adjust regulations as we learn.” By harmonizing rules across 27 countries, MiCA and related digital finance reforms aim to make the EU a fertile ground for tokenization while protecting market integrity.

United States: The U.S. is a paradoxical case. It has the deepest capital markets and cutting-edge fintech, yet regulatory fragmentation (between the SEC, CFTC, federal vs state, etc.) has made it cautious on tokenization. The SEC considers most tokenized assets as securities, meaning any platform trading them must be a registered exchange or ATS, and offerings must be registered or exempt. This has limited public offerings of tokenized stocks/bonds – instead we see private placements to accredited investors. The SEC did provide a 2020 no-action relief for digital asset custody by broker-dealers (with conditions), which a few firms used to start ATS for security tokens (e.g., Osprey, Texture Capital). But broad retail access is not yet there. On the positive side, U.S. regulators are studying tokenization intensely. The Federal Reserve Bank of New York’s Regulated Liability Network (RLN) pilot in late 2022 tested a shared ledger for digital money with major banks, which could ultimately support atomic settlement of tokenized assets with tokenized cash. The CFTC has been more open to innovation – it allowed some crypto derivatives platforms and is exploring how decentralized protocols might register in the future. No major legal reforms specific to tokenization passed Congress yet, but several proposals (like the Digital Commodity Exchange Act, or a potential Stablecoin Act) are in discussion. In summary, the U.S. has no shortage of tokenization projects (e.g., private markets on Securitize, tokenized funds by Franklin Templeton, JPMorgan’s Onyx for intraday repo), but these operate in spite of, not because of, regulatory clarity. Many hope 2025–26 will bring clearer U.S. rules enabling more open tokenized securities trading.

Singapore: Singapore is positioning itself as a global hub for digital assets and tokenization. The Monetary Authority of Singapore (MAS) launched Project Guardian in 2022 and by late 2024 had convened 15+ industry trials with over 40 institutions across 6 currencies (MAS Announces Plans to Support Commercialisation of Asset Tokenisation - The Tokenizer). These trials span bonds, loans, foreign exchange, and funds – essentially prototyping a tokenized financial marketplace. In November 2024, MAS announced it is moving towards commercialization of asset tokenization, forming industry networks to pool liquidity and developing common settlement infrastructure (potentially a wholesale CBDC for atomic DvP, or delivery-versus-payment). Singapore already has enabling regulations – for example, the Payment Services Act covers crypto exchanges and stablecoins (with new amendments proposed to strengthen stablecoin rules), and its securities laws are tech-neutral (so tokenized securities are regulated like traditional ones). One concrete result: in 2024 MAS and Singapore exchanges successfully pilot-tested tokenized fund units being issued and redeemed with payments via SWIFT linkage to blockchain (MAS' Project Guardian pilots settlement of tokenised fund). Also, Singapore is home to licensed security token platforms (ADDX, for instance) that have been operational since 2020. With the government’s strong support and clear guidelines, Singapore will likely continue to attract tokenization projects, from digital bond issuance (e.g., SGX’s Digital Asset issuance platform) to innovative DeFi integrations (MAS has even published papers on embedding policy in DeFi protocols).

Switzerland: As mentioned earlier, Switzerland was an early mover with the DLT Act (2021) that provided legal status to uncertificated securities on DLT and allowed licensed trading venues. As a result, SIX Digital Exchange (SDX) became the world’s first regulated digital securities exchange and CSD, launching with a CBDC pilot and multiple bond issuances (SIX merges Digital Exchange SDX into securities services group). By integrating SDX with its main securities infrastructure, Switzerland effectively mainstreamed tokenized securities under existing law. Swiss banks like Sygnum and SEBA are fully regulated crypto banks that also handle tokenized assets, giving clients a one-stop shop for digital asset services. The Swiss regulator FINMA has also approved a few tokenized fund projects and actively engages in international discussions on crypto standards. In short, Switzerland provides a mature legal environment where a tokenized share or bond is recognized under property law, and this has attracted numerous projects (from foreign exchange tokenization to digital company shares). The country’s stance is to integrate new technology into the famed stability of Swiss financial markets, rather than create separate regimes – a strategy that so far has instilled confidence for issuers like UBS, which felt comfortable issuing a large digital bond on SDX.

United Arab Emirates (UAE): The UAE, particularly Abu Dhabi (ADGM) and Dubai (DIFC), has made significant regulatory strides. The Abu Dhabi Global Market (ADGM) financial center introduced a comprehensive framework for digital securities and cryptocurrencies as early as 2018. In 2024, ADGM’s Financial Services Regulatory Authority issued new consultation papers to update rules for security tokens and stablecoins, aiming to refine and expand the regime (PROPOSED REGULATORY FRAMEWORK FOR THE ISSUANCE OF FIAT-REFERENCED TOKENS, Aug 2024) (ADGM regulatory authority releases consultation paper for security tokens, stablecoins and more, Nov 2024) . Notably, ADGM formally recognized USDT as an accepted token in December 2024 for transactions in the free zone (Abu Dhabi’s financial free zone signs MoU with Chainlink for tokenization frameworks), showing a pragmatic approach to integrating stablecoins. ADGM is also partnering with middleware providers (like Chainlink) to ensure oracles and compliance solutions for tokenized assets are in place. Over in Dubai, the Dubai International Financial Centre (DIFC), via the DFSA regulator, has its own “Investment Tokens” regulatory framework since 2021, and in 2023–24 it expanded a Crypto Token regime to cover utility and exchange tokens (The DFSA enhances its Crypto Token framework, fostering innovation). Outside the free zones, Dubai established VARA (Virtual Assets Regulatory Authority) to oversee crypto activities in the mainland. VARA has attracted global crypto firms and is working on rules that would likely encompass tokenized assets trading as well. With initiatives like the aforementioned Dubai Land Department tokenization pilot (Real-World Asset News: Dubai Starts Real Estate Tokenization Pilot, Forecasts $16B Market by 2033) and various private sector STOs (e.g., a tokenized Sukuk – Islamic bond – was discussed in the region), the UAE is crafting a reputation as a crypto-friendly jurisdiction that also welcomes broader tokenization (with attention to Sharia compliance where relevant, given the importance of Islamic finance there).

Hong Kong: After a period of restraint, Hong Kong has re-embraced fintech and crypto innovation, encouraged by Beijing as part of a strategy to make HK a digital asset hub (even as Mainland China bans crypto trading internally). In 2022 Hong Kong’s SFC (Securities and Futures Commission) issued guidance for Security Token Offerings, essentially requiring them to follow existing securities laws (i.e., only licensed firms can deal in security tokens, and offerings should target professional investors initially). By 2023, Hong Kong made waves by allowing retail trading of crypto on licensed exchanges under strict rules, and by issuing government tokenized green bonds as we discussed (Tracker of New FinTech Applications in Bond Markets » ICMA). The HKMA (Monetary Authority) is also exploring e-HKD (retail CBDC) which could dovetail with tokenized securities for instant payment. Hong Kong’s advantage is a robust legal system and status as a global finance hub; it can leverage that to test tokenized finance in a relatively controlled environment. Expect Hong Kong to possibly launch tokenized ETF products (there were talks of tokenized ETFs through HK’s regime) and more government or corporate bonds on blockchain. The SFC’s cautious but supportive stance means credible, regulated tokenization projects can find a home in Hong Kong, especially to serve the Asian market.

Others: Other jurisdictions of note include Japan, which in 2023 implemented new legislation to allow banks and trust companies to issue stablecoins (and we saw Yen-pegged stablecoins launch). Japan also amended laws to explicitly recognize electronically recorded transferable rights (ERTRs), which cover tokenized securities – early examples include tokenized bond issuance by SBI and SMBC. Australia had a setback with ASX’s blockchain settlement project cancellation, but private sector efforts and a government DLT roadmap continue. UK regulators have been proactive in consulting on digital asset regulation; the UK Financial Conduct Authority (FCA) launched a Regulatory Sandbox for Market Infrastructure in 2023 to let companies test tokenized trading/settlement with temporary rule modifications. The UK Law Commission also released proposals on recognizing digital assets in property law, which would smooth the path for tokenized bonds or equities under English law.

Across the board, a pattern emerges: regulators are no longer ignoring tokenization – they are engaging, creating pilot frameworks, and in some cases explicitly legislating to accommodate the trend. Reports from bodies like the IMF (Tokenization and Financial Market Inefficiencies, Jan 2025) and BIS (Tokenisation in the context of money and other assets: concepts and implications for central banks, Oct 2024) have even discussed the implications of tokenized money and assets on financial stability, generally concluding that while risks exist (tech failures, cyber risks, etc.), the core principles of investor protection and market fairness can be upheld with thoughtful regulation.

Disclaimer: This content is for informational and research purposes only. DYOR!

Updated: 30 May, 2025