Token Standards for RWA Tokenization

Token standards are rules defining how digital tokens work on blockchains in a compliant way, ensuring compatibility for real-world assets (RWAs) like real estate or securities.

RWAs encompass a broad range of assets, including real estate, artwork, bonds, and intellectual property, which are traditionally illiquid and difficult to fractionalize. Tokenization converts these assets into digital tokens on a blockchain, enabling fractional ownership, 24/7 trading, and integration with decentralized finance (DeFi) ecosystems. The process involves representing ownership rights as on-chain tokens, often requiring off-chain data for verification, such as through oracles like Chainlink.

Token standards are predefined rules and functions that govern token behavior, ensuring interoperability and composability across blockchain applications. For RWAs, the choice of standard depends on the asset's nature (fungible or non-fungible), regulatory requirements, and whether vault functionality is needed for yield-bearing assets.

TL;DR:

ERC‑3643 and ERC‑1400 lead in compliance-first, permissioned RWA tokens.

ERC‑4626 excels as the go-to standard for yield-bearing tokenized asset pools—backed by extensive DeFi integration.

ERC‑7540 enables asynchronous vault mechanisms especially suited for real-world liquidity constraints.

1. ERC 3643

Description: ERC-3643 is a permissioned token standard designed specifically for RWAs, focusing on compliance with regulatory requirements. It enables the issuance, management, and transfer of tokens with built-in identity verification and transfer restrictions.

Key Features: Built-in KYC/AML, role-based access, compliance rules, and modular governance.

Use in RWAs: It is ideal for regulated assets like securities, private equity, and debt instruments, ensuring compliance with securities laws. For instance, it is noted for tokenizing assets worth billions, with $28 billion reported in ERC-3643 – The Official Smart Contract Standard for Permissioned Tokens.

Popularity: Its compliance-first design makes it a powerful tool for industries requiring regulatory oversight, such as finance and real estate, as detailed in Introduction to ERC-3643 Tokens.

Real-World Projects:

Plume Network: A full-stack L1 blockchain for RWAfi, using ERC-3643 to enable compliant tokenization and DeFi integration of real-world assets.

Tokeny: A platform leveraging ERC-3643 for issuing and managing compliant security tokens, supporting over $28 billion in tokenized assets.

Polymath: Utilizes ERC-3643 (and previously ERC-1400) for creating regulated security tokens, focusing on institutional-grade RWA tokenization.

2. ERC 1400

Definition: ERC-1400 is a suite of Ethereum-based standards designed for security tokens, enabling the tokenization of real-world assets (RWAs) like stocks, bonds, real estate, and commodities, with a focus on regulatory compliance. It combines standards like ERC-1594 (core functionality, transfer restrictions), ERC-1410 (partial fungibility), ERC-1643 (document management), and ERC-1644 (controller operations) to address compliance, transparency, and asset management.

Key Features: Off-chain key validation, forced transfers, partial fungibility (via ERC 1410), and modular compliance layers.

Use in RWA: Ideal for tokenizing stocks, bonds, real estate, private equity, supply chain assets, and asset-backed tokens, offering fractional ownership, transparency, and compliance.

Popularity: Foundation for security token ecosystems; supported by ConsenSys, Codefi, Taurus, and others. While innovative, ERC-1400 is not as dominant due to its complexity and lack of official Ethereum standardization.

Real-World Projects:

Polymath’s ST20 token relies on ERC‑1400 for compliant security token issuance.

3. ERC 4626

Definition: ERC-4626 is an Ethereum-based standard for tokenized vaults, designed to optimize and standardize yield-bearing assets, including real-world assets (RWAs) like investment funds, bonds, or tokenized loans. It focuses on fungible tokens representing shares in a vault, enabling standardized deposit, withdrawal, and yield accrual processes.

Key Features: Standard methods for minting shares, accounting, and harvesting returns in yield-bearing vaults.

Use in RWA: Enables tokenized return-generating asset pools—e.g. real estate investment trusts (REITs), bonds, debt instruments—integrated with DeFi strategies.

Popularity: Incorporated by 50+ vaults since mid‑2022, with the ERC‑4626 Alliance supporting adoption. Widely adopted in DeFi for yield optimization, with growing use in RWA tokenization due to its efficiency and interoperability.

Real-World Projects:

Yearn Finance V3: A leading DeFi protocol using ERC-4626 for yield optimization vaults, including some RWA-backed strategies.

Aave: Incorporates ERC-4626 for standardized lending vaults, supporting tokenized RWA loans and yield generation.

RWA Vault by ETHGlobal (Mantle): uses ERC‑4626 to let users deposit into a mixed RWA basket

SeaSeed Network: A public-permissioned chain built for compliant finance—leverages ERC‑4626 to power its institutional vaults.

4. ERC 7540

Definition: An extension of ERC-4626, ERC-7540 supports asynchronous deposit and redemption for tokenized vaults, enhancing efficiency for yield-bearing assets. It standardizes the behavior of tokenized vaults, allowing for flexible management of investment returns.

Key Features: Designed for assets with non-instant liquidity; supports flexible, timed redemption patterns.

Use in RWA: Useful in tokenizing assets like receivables or private credit, where funds aren’t instantly liquid.

Popularity: Its focus on yield-bearing RWAs aligns with the growing demand for DeFi integration, making it a significant standard for investment-focused tokenization. It is often used for assets that generate yield, such as tokenized bonds or investment funds.

Real-World Projects:

Centrifuge: An early adopter, using ERC-7540 for tokenized vaults in RWAfi, enabling asynchronous deposits for assets like invoices.

5. ERC 20 & ERC 721 (Baseline Standards)

ERC‑20: Generic fungible tokens, including utility and governance tokens, though it lacks RWA-specific features. Widely adopted but no intrinsic compliance layers. Eg: Uniswap, Chainlink, Tether (USDT)

ERC‑721: Non-fungible tokens, popular for unique assets like art and collectibles (e.g., CryptoKitties), less suited for fractional, fungible RWA assets. Eg: CryptoKitties, Bored Ape Yacht Club (BAYC), Decentraland

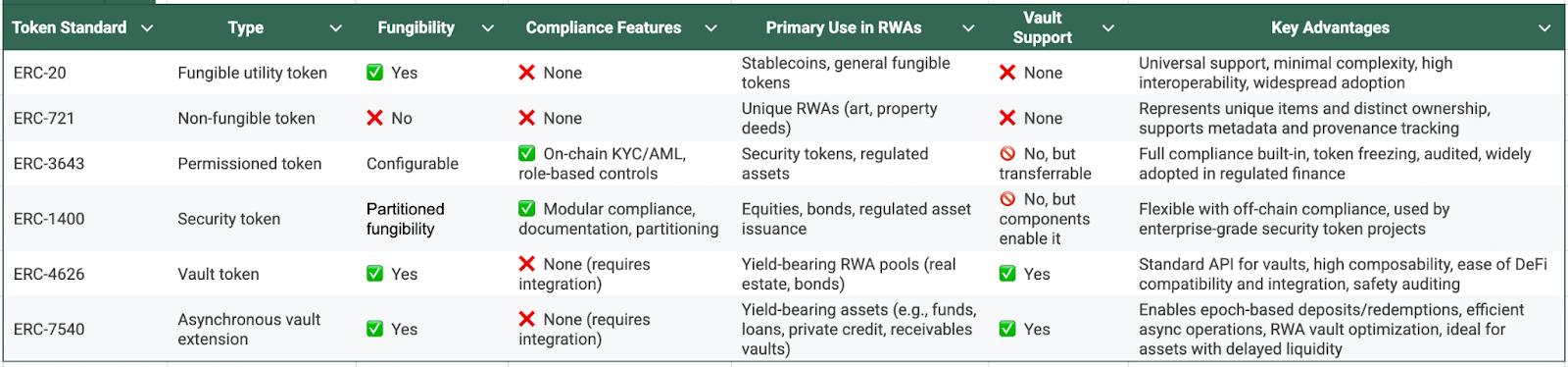

Side-by-side Comparison Table

Final Thoughts

ERC-20, ERC-721, ERC-3643, ERC-1400, ERC-7540, and ERC-4626 are relevant token standards for tokenizing RWAs, each serving distinct purposes from fungible assets to regulated securities and yield-bearing vaults.

ERC‑3643 and ERC‑1400 are leaders for regulatory-compliant RWA tokenization.

ERC‑7540 opens doors to asynchronous, real-world asset strategies. ERC‑4626 is the go-to standard for yield-bearing tokenized asset pools with strong industry adoption.

Ethereum's dominance, driven by its ecosystem and developer support, underpins their adoption, though other blockchains may offer alternative standards. As the RWA market continues to grow, these standards will likely evolve to address emerging needs, particularly in compliance and interoperability.

Note: There are other standards suitable for tokenization—such as Token Extensions on Solana—that offer advanced control and modularity. However, this article focuses exclusively on ERC standards.

Disclaimer: This content is for informational and research purposes only. DYOR!

Find me on x.com/0x9121Alex