Backed Finance: Comprehensive Analysis

When Swiss startup Backed Finance quietly tokenized a handful of bond ETFs in 2023, few outside the real-asset niche noticed. Eighteen months later the team has flipped the lights on an entire stock market, including Apple, Tesla, even the S&P 500, trading permissionlessly on-chain, 24/7, under a fully approved EU prospectus. In an ecosystem crowded with Treasury-bill wrappers and private-credit pools, Backed stands apart for three reasons:

Regulated‑but‑Permissionless Structure: The legal clarity + permissionless transfer combo

Wide Range of Assets + CEX/DEX liquidity + DeFi composability at scale

Dual‑Layer Oracle Stack (Internal + Chainlink): The hybrid, swap‑in/swap‑out oracle design + automated PoR on-chain

In this piece, we’ll dig into how Backed Finance nailed its winning trio.

1. Company Overview

Founded in 2021 in Zug, Switzerland; core team includes Adam Levi, Roberto Klein, and Yehonatan Goldman. Headquarter in Switzerland .

Issuer entity: Backed Assets (JE) Limited (Jersey-based).

Raised $9.5M in Series A (2024) from Gnosis, Exor Seeds, Cyber Fund.

Mission: bring traditional securities (stocks, bonds) onto public blockchains.

Website: https://backed.fi/

2. Regulatory & Compliance

Backed Finance AG is fully regulated via a Base Prospectus approved by Liechtenstein FMA. This means Backed’s tokenized securities have a regulated prospectus that can be passported across the EU for offerings to qualified investors. The issuing vehicle, Backed Assets (JE) Limited, is registered in Jersey and operates with consents from the Jersey Financial Services Commission, while being 100% owned by Backed Finance AG (Switzerland).

Backed’s tokenized assets are not offered to the general public. Sales occur only through licensed partners and to investors who meet certain qualifications (e.g. “Qualified Investor” under EU Prospectus Regulation and professional client criteria under Swiss law), no U.S. or UK retail access.

Custody, AML, and prospectus audits in place — conservative TradFi compliance with crypto flexibility. Backed’s tokenized tokens are fully regulated securities (with an EU-approved prospectus and Swiss legal validity) but use blockchain as the settlement infrastructure

Switzerland and Liechtenstein’s crypto-friendly regulations give Backed Finance a competitive edge, particularly for EU market access.

3. Tokenized Offerings

Backed Finance issues Backed Tokens - bTokens (Tokenized bond ETFs & index funds) and xStocked (Tokenized individual stocks & ETFs). bTokens / xStocks = ERC-20/SPL tokens fully backed 1:1 with an underlying real-world asset. Each Backed token is fully collateralized by the actual asset it represents: for every token in circulation, an equivalent share or bond is held by a custodian.

Product types:

Blue-chip stocks: Over 60 large-cap equities have been tokenized via xStock on Solana in mid-May, 2025 (e.g. AAPLx, TSLAx, METAx)

ETFs & bond funds (e.g. bCSPX, bIB01, bERNX)

Commodities and Others: Gold xStock (likely representing a gold ETF or trust), actively managed funds (AMC) like Fortlake Asset Management, pre-IPO equity (CRCLx, DFDVx).

Backed’s tokens do not have transfer restrictions on-chain - All tokens DeFi-ready, multi-chain (including Ethereum, layer-2s like Arbitrum and Base, sidechains like Polygon, Gnosis Chain, Avalanche, Fantom, BNB Chain, and Solana). Cross-chain interoperability is facilitated by Chainlink’s CCIP bridge in 2024-2025.

4. Tokenization Process (End-to-End)

Step 1: Asset Selection and Legal Structuring: Legal setup – asset structured under Swiss tracker certificate law. Backed can tokenize virtually any publicly traded security or a basket of securities as long as they ensure that the target asset is eligible, and then arrange the issuance within its regulatory umbrella within weeks.

Step 2: Token Issuance (Minting and Sale to Investor): The issuance mechanism is streamlined via Backed’s platform. A primary investor (one who has onboarded with Backed and passed KYC/AML checks) initiates an issuance order by selecting the asset and the blockchain network for the tokens > investor sends USDC to a unique deposit address provided by Backed > trigger Backed’s system to begin the token minting process > Backed will convert the stablecoins to fiat currency and buy asset via broker (e.g., Alpaca) in the real market > token minted. (Backed guarantees the issuance of investor’s bTokens within two business days (T+2), but for many orders, especially those of smaller size, they can complete the issuance within a few minutes utilizing their working capital)

Step 3: Distribution and Trading: Secondary trading – tokens traded on CEXes like Kraken, Bybit (act as Authorized Participants or liquidity providers: they (or their market makers) can go to Backed to issue or redeem tokens in bulk, then make markets on the exchange), and DEXes (e.g., Jupiter, Raydium). Backed works with market makers (including exchange-affiliated ones) to ensure tight pegs between token prices and underlying asset prices, and uses oracles (next section) to broadcast fair values on-chain.

Step 4: Redemption and Settlement – holder sends back tokens, asset is sold, fiat/stablecoin returned. Backed targets a redemption completion time of T+3 business days (three days) at most, though small redemptions can often be fulfilled within minutes using Backed’s own liquidity before the underlying trade settles. During market hours, redemptions and issuances are executed promptly, whereas requests outside market hours queue until the underlying exchanges open

Handling Corporate Actions: Backed manages corporate actions like dividends and stock splits for tokenized assets. Dividends are typically passed to token holders by increasing token quantity or value, often through rebasing the token supply. However, such rebasing could confuse DeFi contracts, to avoid it, Backed offers wrapped tokens (wbTokens) that do not rebase with corporate actions, allowing bTokens to be used in liquidity pools or lending markets. Users who want to use bTokens in liquidity pools or lending markets can convert them to wbTokens to avoid unexpected balance changes.

5. Stakeholders and Roles

Issuer: Backed Assets (JE) Ltd. is the company that legally issues the tokenized security and holds the obligations to token holders

Technology Provider: Backed Finance AG - tokenization platform operator, serves as the developer of the platform and the orchestrator of on-chain processes

Custodians: (often chosen based on asset type or region) Maerki Baumann, InCore Bank (CH), Alpaca Securities (US) – hold the real assets.

Brokers: There is overlap between brokers and custodians in Backed’s case. The brokers are the entities that execute buy/sell orders for the underlying assets. Maerki Baumann and InCore Bank can execute trades (as they have trading desks or brokerage capabilities), and Alpaca Securities specifically is listed as a broker for underlying assets as well.

Security Agent: Security Agent Services AG (Zug, Switzerland) oversees asset collateral, protects investor claims, and guarantees the linkage between tokens and assets is maintained for the investors’ benefit.

Investors (Primary and Secondary): primary investors provide liquidity and initial capital to bring real assets on-chain (they signal demand for new tokens or for redemptions), whereas secondary investors provide market depth and trading activity, making the tokens useful and liquid. All investors rely on the framework in place (trust that tokens are redeemable 1:1 for assets and that custodians hold those assets).

Oracle Providers: Chainlink and Backed’s own oracle infrastructure. Network Firm (auditor) and Chainlink’s Proof of Reserve oracles form part of the oracle mechanism.

Exchanges & LPs: CEXes such as Kraken, Bybit, DEXes – secondary liquidity: facilitating trading and price stability for Backed’s tokens once issued.

Auditor (The Network Firm): The Network Firm has view-only access to Backed’s custody accounts at the banks via API, and it periodically checks that the number of real assets in custody matches or exceeds the number of tokens in circulation. The auditor then signs off on this data, which is fed into the Chainlink PoR oracle.

Financial Regulators: The Liechtenstein FMA, Swiss FINMA (implicitly, via Swiss DLT law and possibly Swiss prospectus recognition), the Jersey FSC, and any authorities where the prospectus is passported (e.g. EU countries’ regulators)

6. Price Oracle

Multi-source oracle model:

Internal oracle + “Oracle Forwarder” smart contract > allows Backed to upgrade or switch the price source without changing the addresses that integrators query

Chainlink provides decentralized data streams for xStock + Proof-of-Reserve.

Price updates: Two‑layer Forwarder → Internal Oracle design (can be repointed to Chainlink if desired) at least once per day or on >10% deviation - apply for bToken; Chainlink Data Streams offer sub-second latency for xStocks.

Transparent price feeds live at https://defi.backed.fi/oracles. The price feed is used by DeFi applications to determine collateral values, by exchanges for reference, and by users who want to verify the fair value on-chain.

7. Partnerships & Integrations

CEX: Kraken, Bybit ( ETF tokens and xStocks listed June 2025, live in 190+ countries).

DeFi (Solana): Phantom/Solflare wallet, Jupiter (for swapping at best rates), Raydium (for LPing), Kamino Finance (for swapping and lending) – xStocks integrated at launch.

Chainlink: Oracles, CCIP cross-chain bridge, Proof-of-Reserve (multiple Chainlink nodes pull audit data (from The Network Firm) to confirm the number of real assets held, and post that on-chain for public verification)

Institutions:

INX (to list bNVDA on the regulated ATS), Assetera (as a European regulated digital asset exchange, to list Backed’s tokenized NVIDIA, Coinbase, and S&P 500 products on Polygon network to sell to EU/Middle East-based investors), eNor Securities (aim to have Backed’s tokenized securities offered to retail investors in LATAM through eNor’s platform).

Fortlake (tokenized bond fund), Alchemy Pay (fiat on-ramps/off-ramps for tokenized stocks).

Tokens used in DeFi protocols: Morpho (the creation of real-world yield vaults allows users to deposit stablecoin and earn yield sourced from Backed’s bond tokens), Angle Protocol (accept bTokens as bCSPX or other bond tokens as collateral for minting its stablecoin as agEUR/USDA), PayPal PYUSD vaults (PYUSD gets DeFi yield powered by Backed’s RWA vault on Morpho).

8. Market & Investor Data

Series A in April, 2024 ($9.5M) led by Gnosis, Exor, Cyber Fund, Mindset Ventures, Stake Capital, Blockchain Founders Fund, Nonce Classic, BlueBay Ventures, and more.

By mid-2025, according to RWA.xyz:

70+ tokenized stocks/ETFs

$158M+ in tokenized assets

$6.6M daily trading volume (xStocks on Solana) on 1st July with 6,500+ daily active traders

Integrated across Ethereum, Solana, and 8+ chains via CCIP.

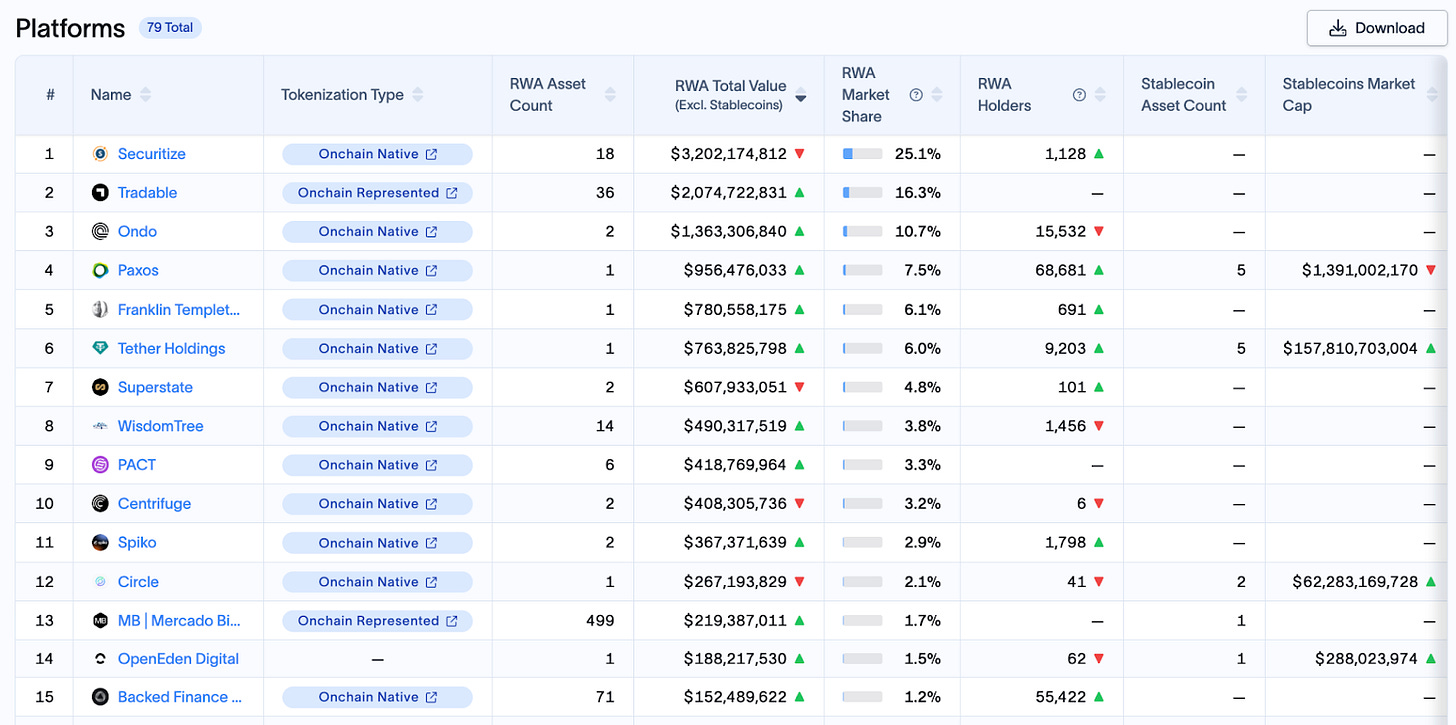

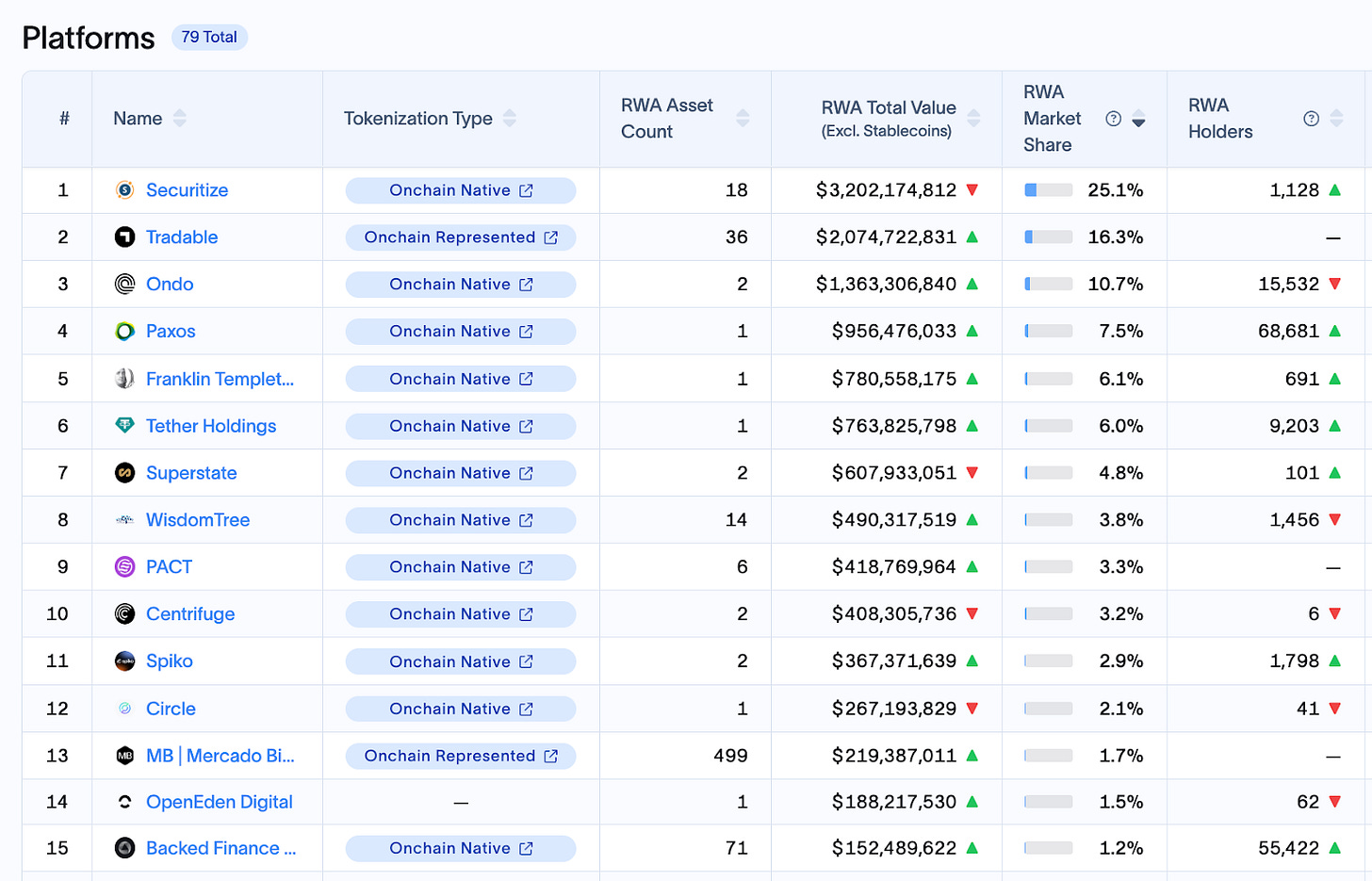

According to RWA.xyz dashboard, Backed Finance holds the second position in total RWA asset count with 71 tokenized assets, trailing Mercado Bitcoin (499 assets). However, it ranks 15th in both total RWA value ($152M) and market share (1.2%).

RWA Asset Count Ranking (Data captured in mid-July, 2025)

RWA Total Value Ranking (Data captured in mid-July, 2025)

RWA Market Share Ranking (Data captured in mid-July, 2025)

9. Security & Custody

All assets held with licensed third-party custodians (Swiss & US banks).

Security agent ensures investor protection + collateral ring-fencing.

Chainlink Proof-of-Reserve + auditor attestation (The Network Firm) = daily on-chain collateral checks. (The Network Firm, as a reputable crypto auditor (also auditing USDC), daily audits Backed's custodial holdings via API, checking assets like Apple shares against AAPLx tokens.)

Smart contracts secure, upgradeable oracles, no admin minting without asset backing, multi-signature operations for critical actions.

Whitelisted issuance/redemption; free transfer on secondary; AML controls; Insurance and Consumer Protection (investors might have SOME protection similar to structured product investors. For example, if the issuer were insolvent, token holders would have recourse to the underlying assets held by the security agent)

10. Roadmap & Vision

Expanded Tokenized Asset Suite: Continuously adding new assets beyond stocks and bond ETFs, including potential commodities, international equities, real estate trusts, and non-public assets. Focus on listed securities globally and "Tokenization as a Service" for institutional clients.

Global Accessibility and Retail Distribution: Penetrating new markets through partnerships and regulatory filings, localizing offerings under regional regulations (e.g., LATAM, Middle East/Europe). Potential expansion into the UK market.

Regulatory Developments: Ensuring compliance with emerging regulations like Europe's MiCA and exploring potential entry into the U.S. market.

Enhanced Product Features: Exploring the pass-through of governance rights and automatic dividend distribution to token holders for a more complete ownership experience.

Scalability and Performance: Focusing on high-throughput trading by supporting additional high-speed chains and remaining chain-agnostic via Chainlink's CCIP.

Institutional Tokenization Platform: Developing a B2B "Tokenization Platform" offering white-label or API services for asset managers to create tokenized funds.

Metrics and Targets: Aiming for hundreds of tokenized assets and surpassing $1 billion in tokenized assets in the medium term.

Long-Term Vision: Building an open, efficient, and inclusive global financial system, exploring advanced features like flash issuance and dynamic baskets, and potentially launching a governance token or DAO.

Backed’s future plans involve scaling up (more assets, more users, more markets), streamlining the user experience (faster oracles, direct fiat on-ramps, dividend handling), and cementing partnerships (with both crypto platforms and TradFi institutions) to solidify its role as a bridge.

~~~

SWOT Analysis

Strengths

Regulated + Permissionless: EU/Liechtenstein‑approved prospectus, yet tokens stay standard ERC‑20/SPL with no transfer gate.

Broad Asset Menu: 55‑60 tokenized blue‑chip stocks/ETFs (“xStocks”) plus bond‑ETF bTokens—widest catalog in RWA space.

Active Secondary Liquidity: Listings on Kraken, Bybit and Solana/EVM DEXs deliver 24‑hour trading and deep order books.

Dual‑Layer Oracle + PoR: Forwarder‑based internal oracles (daily/ >10 % rule) + Chainlink Data Streams / PoR attested every 10 min by The Network Firm.

Weaknesses

U.S. Exclusion: Tokens barred to U.S. persons, shrinking TAM.

Custodian Dependence: Assets sit with Maerki Baumann, InCore, Alpaca—single‑points‑of‑failure for redemption.

Documentation Lag: GitBook oracles page covers only bTokens; xStock specs live in blog posts.

Multi‑jurisdiction Complexity: Swiss, EU, Jersey layers expose Backed to evolving rule sets (e.g., MiCA).

Opportunities

First‑Mover in Tokenized Equities: Capture DeFi collateral & retail demand before larger incumbents match breadth

Institutional White‑Label Deals: Fortlake partnership shows revenue path as a tokenization‑as‑a‑service stack.

Stablecoin/DAO Treasuries: Angle’s stUSD / stEUR already hold Backed bTokens—template for more RWA‑backed stablecoins.

Cross‑Chain Reach: CCIP integration lets tokens move natively across L2s & Solana, widening the user base.

MiCA Tailwind: EU‑wide MiCAR in force (Dec 2024) standardizes crypto‑asset rules; Liechtenstein FMA implements regime—creates more licensed CASPs able to list/back Backed tokens across the EU.

Threats

Heavyweight Rivals: Securitize‑BlackRock BUIDL, Franklin BENJI wrappers, Ondo OUSG/USDY scaling fast.

Regulatory Drift: Future MiCA technical standards or local rules could mandate on‑chain transfer controls, undercutting permissionless design.

Custodian Risk: Any failure/freeze at Maerki Baumann, InCore, Alpaca would stall redemptions & PoR feeds.

Technological risks: Reliance on upgradeable contracts, CCIP bridges, fast oracles increases exploit exposure (industry‑wide risk), other risks are such as oracle failures or blockchain interoperability issues.

Unique Value Propositions & Success Factors of Backed Finance

Regulatory Innovation + Global Reach

Operates under a Swiss/EU-approved prospectus, giving legal legitimacy.

Tokens are freely transferable on-chain (no whitelist on transfers) while still enforcing KYC/AML at issuance and excluding U.S. persons.

Delivers high regulatory assurance without sacrificing crypto’s permissionless nature—unlike many rivals that confine tokens to gated, accredited-only ecosystems.

Broad, Equity-Inclusive Asset Menu

Tokenizes a wide spectrum of RWAs: blue-chip stocks, ETFs, government and corporate bond funds (not just Treasuries or private credit).

Turns crypto wallets into “mini brokerages,” letting users hold Apple/Tesla tokens alongside bond ETFs and crypto.

Enables multiple strategies: use stock tokens as collateral, hedge crypto exposure with bond tokens, or build diversified on-chain portfolios.

DeFi-Native, Composable Token Design

Standard ERC-20/SPL tokens with no transfer friction, ready for DEXs, lending protocols, and yield strategies.

Integrated Chainlink Price Feeds + Proof-of-Reserve for real-time valuation and collateral verification—instills trust for users and protocols.

Multi-chain + CCIP interoperability means tokens can move to wherever liquidity and innovation are (Ethereum L2s, Solana, Avalanche, etc.), keeping Backed agile.

Deep Liquidity & 24/7 Market Access

Listed on major CeFi exchanges (Kraken, Bybit) and regulated digital asset exchanges (Assetera, eNor)—first-mover breadth few RWA issuers match.

Continuous, around-the-clock trading (no stock market hours) builds tight price/NAV alignment via arbitrage and market making.

Presence on both CeFi and DeFi surfaces (DEXs, lending markets) creates a larger combined liquidity pool, accelerating adoption.

Strategic Alliances that Bridge TradFi and DeFi

Partnerships span regulated exchanges, DeFi protocols (Chainlink), data providers, asset managers (Fortlake) and payment gateways (Alchemy Pay).

Chainlink PoR and price oracles set an industry standard others now follow—Backed becomes the reference model.

Embeds itself into existing financial networks and crypto rails simultaneously, positioning Backed as a long-term infrastructure layer for tokenized capital markets.

Disclaimer: This content is for informational and research purposes only. DYOR! Open to discussion.

Find me on x.com/0x9121Alex